Cameco stock: uranium champion pauses after powerful multi?month rally

28.12.2025 - 08:56:03Cameco stock has cooled over the past few sessions, but the broader uranium uptrend and tightening supply backdrop keep the long?term bull case very much alive.

Cameco stock has spent the past few days catching its breath after an aggressive advance that pushed the uranium giant close to its 52?week highs. Short?term traders are locking in profits, but the broader tape still tells the story of a cyclical leader in a structurally tightening market for nuclear fuel.

Cameco stock: real?time information, company background and investor resources

Over the last five sessions the share price has been choppy, with intraday swings reflecting a tug of war between macro worries and uranium bulls leaning into any dip. Even with this noise, the 90?day trend remains firmly upward, and the stock is trading much closer to its 52?week high than to its low, a classic sign that institutional money is still aligned with the long?term thesis.

Technically, support from the rising 50?day moving average has become an important line in the sand, while resistance sits just below the recent peak that marked the latest leg of the rally. As long as Cameco stock holds above that medium?term support, the current consolidation looks more like digestion than distribution.

One-Year Investment Performance

An investor who bought Cameco stock exactly one year ago would be sitting on a striking gain today. Based on the current price versus the closing level a year back, the position would show a double?digit percentage return, comfortably outperforming major equity benchmarks and most traditional energy plays.

To put that in perspective, a hypothetical 10,000 dollars invested in Cameco back then would now be worth roughly 13,000 to 16,000 dollars, depending on the precise entry point and currency, while broad market index exposure would have delivered far more modest upside. The engine behind this outperformance has been a powerful repricing of uranium as governments lean back into nuclear power and utilities race to secure long?term supply.

The journey has not been smooth. Cameco stock has endured several pullbacks of 10 percent or more along the way, shaking out weak hands before marching higher again. Investors who were willing to tolerate that volatility and stick with the structural thesis have so far been richly rewarded.

Recent Catalysts and News

Over the past week, market attention around Cameco has revolved less around eye?catching headlines and more around the broader uranium narrative. Spot uranium prices have remained elevated compared with historic norms, which quietly underpins sentiment even when company specific newsflow is thin. Traders have been quick to interpret any small dip in the commodity as an excuse to take profits in the stock, creating the whippy, rangebound behavior seen in recent sessions.

Earlier in the period, investors continued to digest Cameco's recent quarterly update and operational commentary, which highlighted steady progress in ramping production at its flagship Canadian assets while maintaining a disciplined approach to contracting. Management has reiterated its focus on value over volume, preferring long?term, higher quality contracts over chasing every ton of potential output. In the absence of fresh headlines in the last few days, the stock has effectively entered a consolidation phase with relatively contained volatility, as the market waits for the next demand or supply shock in uranium to reset expectations.

Another theme in recent trading has been the ongoing debate over nuclear's role in the global energy transition. Headlines about policy support for new reactors and life extensions of existing fleets in North America, Europe and parts of Asia have continued to surface, indirectly supporting Cameco's long?term narrative even if they do not directly reference the company. Each incremental sign that nuclear remains in the decarbonization mix tends to put a higher strategic value on Cameco's reserves and conversion capabilities.

Wall Street Verdict & Price Targets

On the sell?side, Cameco continues to enjoy predominantly constructive coverage. Large houses such as Bank of America, J.P. Morgan and Morgan Stanley classify the stock in the Buy or Overweight camp, reflecting confidence in the uranium cycle and in Cameco's leverage to higher prices. Across the analyst community, the consensus 12?month price target sits above the current share price, implying additional upside from here, even after the strong run of the past year.

There are, however, nuances beneath the bullish headlines. Some brokers have recently nudged their targets higher to capture the shift in long?term uranium price assumptions, but they also warn that short?term swings could be violent if macro risk sentiment sours or if spot prices correct. A minority of analysts take a more cautious Hold stance, arguing that a large part of the good news is already reflected in the valuation after the stock's sharp re?rating. In aggregate, though, the Wall Street verdict still tilts clearly in favor of accumulating Cameco on weakness rather than selling into strength.

Importantly for institutional investors, Cameco remains a high?conviction way to express a view on nuclear's resurgence that is easier to underwrite than early stage explorers or highly leveraged peers. That positioning helps explain why the stock frequently responds strongly to any upgrades or target hikes from banks with significant influence over global portfolio flows.

Future Prospects and Strategy

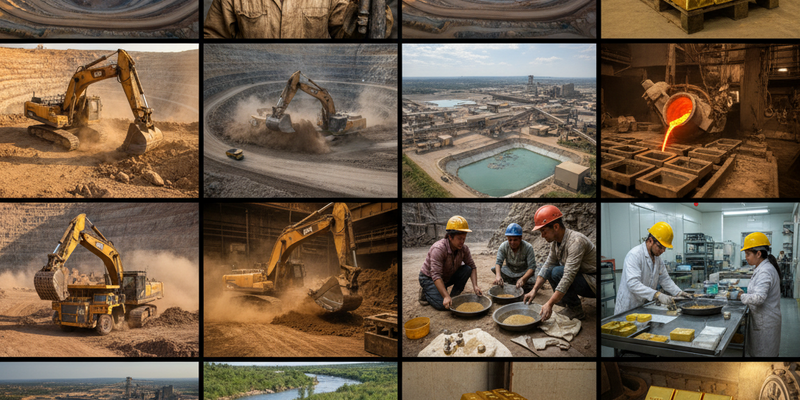

Cameco's business model is built around owning and operating some of the world's best uranium assets, coupled with a growing presence in fuel services and conversion, giving it exposure across a critical part of the nuclear fuel value chain. The company's strategy is to bring production back in a measured way, matching volumes to what it sees as structurally rising utility demand rather than flooding the market. This discipline, combined with a solid balance sheet, positions Cameco to benefit disproportionately if uranium prices remain firm or move higher.

Looking ahead to the coming months, several factors will likely dictate how the stock trades: the path of global interest rates, investor appetite for cyclical commodities, and any further policy momentum behind nuclear energy in major economies. On the micro side, investors will watch closely for updates on production ramp?ups, contract wins and any cost inflation pressures across its portfolio. If the current consolidation resolves to the upside, Cameco could attempt to set new 52?week highs, while a deeper risk?off correction would probably be viewed by long?term bulls as an opportunity to add exposure to a company that sits at the center of a still unfolding uranium supercycle.