Cameco’s Uranium Surge: One-Year Run, Analyst Upgrades and What Comes Next

22.12.2025 - 13:47:14Uranium champion Cameco has ridden the nuclear power revival to fresh highs. Here’s how the stock has moved, what a one-year bet would look like, how Wall Street is positioned – and which catalysts could drive the next leg.

Uranium has roared back from the cold, and Cameco Corporation has been at the heart of that revival. As utilities lock in long-term nuclear fuel and investors reposition for an extended atomic age, the Canadian producer’s share price has traced a powerful, if volatile, uptrend.

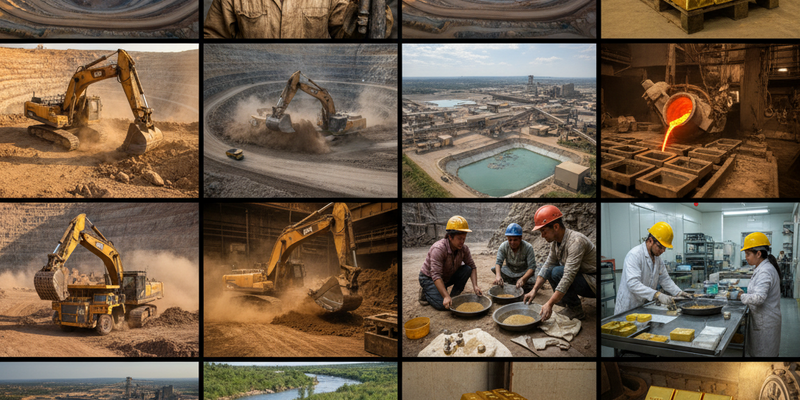

Cameco Corporation Aktie: uranium pure play in a nuclear power revival

One-Year Investment Performance

On the Toronto Stock Exchange, Cameco shares recently changed hands around the low C$70s, after touching a 52?week high in the mid?C$70s and a low near the mid?C$40s. Over the past five trading days the stock has consolidated just below its peak, reflecting a pause after a strong autumn rally. Stretch the lens to 90 days and the picture shifts from sideways noise to a clear bullish trend: the stock has climbed sharply as uranium prices pushed higher and investors priced in tighter supply.

If an investor had bought Cameco one year ago, when the stock traded closer to the mid?C$40s, the position today would sit on a gain of roughly 55–65%, depending on the exact entry point and currency. In simple terms, a C$10,000 investment a year ago would now be worth in the region of C$15,500–C$16,500, turning uranium from a fringe allocation into one of the standout performers in the broader resources space.

Recent Catalysts and Market Momentum

The underlying driver of Cameco’s rally remains a structural shift in sentiment towards nuclear power. Governments from Europe to Asia have moved from phasing out reactors to extending lifetimes and green?lighting new builds as they grapple with energy security and decarbonisation. That policy pivot has amplified an already tight uranium market, where years of underinvestment and mine suspensions left inventories thin just as utilities returned as aggressive buyers. Spot uranium prices have surged, and term contracting has accelerated, giving Cameco a far firmer pricing backdrop than it faced for most of the past decade.

Operationally, the company has been executing on a ramp?up of its tier?one assets, notably the Cigar Lake mine and the McArthur River/Key Lake complex in Saskatchewan’s Athabasca Basin. Recent updates have underlined Cameco’s strategy of prioritising long?term, market?related contracts instead of flooding the spot market, effectively tightening available supply. At the same time, geopolitical risks around Russian nuclear fuel and uncertainty in other producer jurisdictions have pushed Western utilities to diversify supply chains, with Cameco near the top of their shopping lists. The stock’s five?day consolidation is less a loss of faith than a breather after a forceful 90?day climb that saw it revisit and briefly eclipse its 52?week high.

Financial Verdict & Wall Street Ratings

Analysts have largely raced to keep up with the share price. In recent weeks, Canadian banks have reiterated broadly constructive views on Cameco, pointing to improved contract coverage, rising realised prices and leverage to any further uranium price strength. RBC Capital Markets continues to frame Cameco as a core holding for institutional investors seeking liquid uranium exposure, while peers at TD Securities and BMO Capital Markets have highlighted the company’s balance sheet strength and disciplined production strategy. Across the Street, the consensus leans toward “buy” or “outperform”, with some houses nudging up their target prices over the past month to reflect both the uranium price rally and Cameco’s higher?than?expected contract volumes. Even where ratings sit at “hold”, the language tends to focus on valuation after a big run rather than on any structural concern about the business model.

Future Prospects and Strategy

Looking ahead, the key question is whether the uranium cycle still has room to run and how Cameco chooses to ride it. The company has signalled that it will not chase volume for its own sake, preferring to bring on additional production only when backed by long?term contracts at attractive prices. That discipline gives it optionality: if uranium remains in deficit, Cameco can layer in richer contracts and gradually lift output, feeding through to higher cash flow over several years rather than front?loading the cycle. Its integrated positioning in the nuclear fuel value chain, coupled with Western governments’ desire for secure, non?Russian supply, should keep it central to utility procurement strategies.

Risks remain. A global economic slowdown, a reversal in nuclear policy, or operational setbacks in the Athabasca Basin could challenge the bullish narrative. After such a strong 12?month run, the stock is also vulnerable to bouts of profit?taking if uranium prices stall. Yet as long as the structural drivers – energy security, decarbonisation and under?supplied uranium markets – stay intact, Cameco retains the profile of a cyclical leader in a newly strategic commodity. For investors who weathered the long nuclear winter, the past year has been vindication; for those arriving late, the debate now centres not on whether the cycle is real, but on how long it can last.